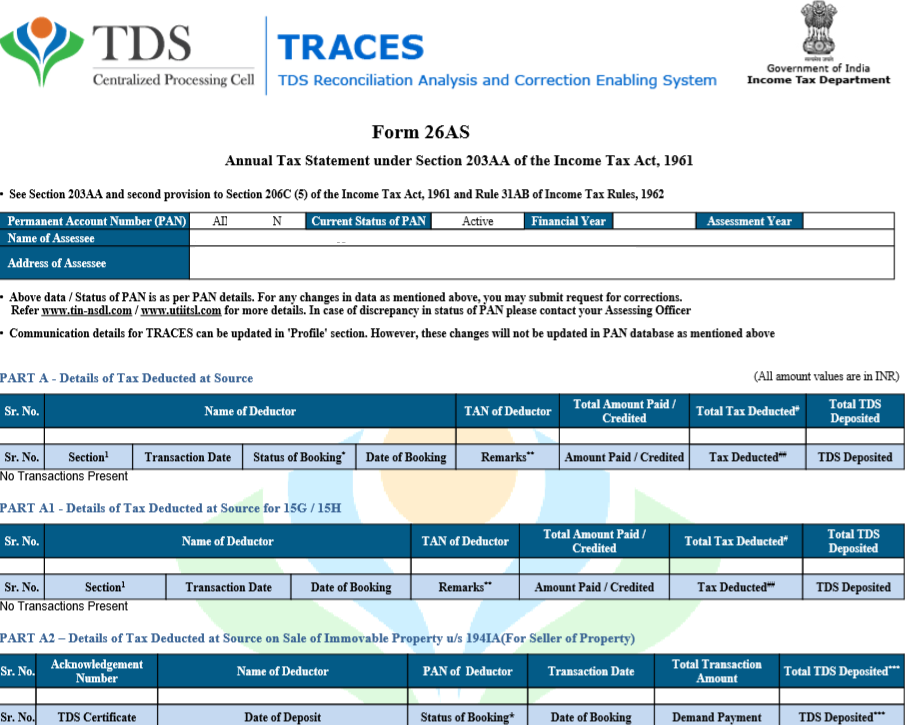

In other words form 26AS tax credit statement is a consolidated income tax statement. What represents B. Form 26AS is introduced by income tax department and tdscpcl. The password to open form 26AS is taxpayers date of birth in DDMMYYYY format. Transaction date means date of credit or payment whichever is earlier. 19 June 2012 What does mean in Form No. So form 26AS means compilation of all these tax related transactions related to a PAN card l for a specific financial year as per the Income tax records. Therefore it is important that the tax payer should compare the. It also displays your advance tax or any self-assessment tax that have been paid during financial year during that year. Form 26AS is a consolidated tax statement issued to the PAN holders.

So form 26AS means compilation of all these tax related transactions related to a PAN card l for a specific financial year as per the Income tax records. What is Form 26AS. Read the disclaimer click Confirm and the user will be redirected to TDS-CPC Portal. Transaction date means date of credit or payment whichever is earlier. Form 26AS is a consolidated annual statement which is maintained by the Income Tax Department. Income Tax department keeps all your tax-related data in their database through 26AS. So TDS deductions that are given in Form 16 Form 16 A can be cross checked using Form 26AS. The IT department also tallies all. 19 June 2012 What does mean in Form No. It contains tax credit information of each Taxpayer against his PAN.

Form 26AS is an annual consolidated credit statement issued with regards to your PAN. Date of booking means the date on which TDS return is processed and amount booked in 26AS. Therefore it is important that the tax payer should compare the. Form 26AS is an annual statement which includes all the details pertaining to the tax deducted at source TDS information regarding the tax collected by your collectors the advance tax you have paid self-assessment tax payments information regarding the refund you have received over the course of a financial year regular assessment tax that you have deposited and information regarding. What represents B. If you have paid any tax on your income or tax has been deducted from it then Income Tax Department have these details in their Form 26AS database. Go to the My Account menu click View Form 26AS Tax Credit link. SFT basically means specified financial transaction mentioned under rule 114E of the Income Tax act wherein few specific transactions have been listed which needs to be reported by specified. Form 26AS is introduced by income tax department and tdscpcl. Read the disclaimer click Confirm and the user will be redirected to TDS-CPC Portal.

What is the transaction date and date of booking in form 26as. 19 June 2012 What does mean in Form No. What is Form 26AS. Transaction date means date of credit or payment whichever is earlier. With the help of Form 26AS we can view all the detail relating to income tax paid TDS deduction refund and transaction relating Annual Information Report etc. Form 26AS is a statement which is maintained by the Department of Income Tax on an annual basis. Form 26AS is introduced by income tax department and tdscpcl. In other words form 26AS tax credit statement is a consolidated income tax statement. The TDS amounts reflected in Form 26AS and Form. Read the disclaimer click Confirm and the user will be redirected to TDS-CPC Portal.

It is a really useful tool which not only gives you annual tax related information but also saves you from income tax noticesIn this part we will analysis each part of form 26AS. To view Form 26AS or download Form 26AS from the Income Tax Website read our complete guide on How to View Tax Credit Statement Form 26AS. In other words form 26AS tax credit statement is a consolidated income tax statement. Please Reply the same. SFT basically means specified financial transaction mentioned under rule 114E of the Income Tax act wherein few specific transactions have been listed which needs to be reported by specified. Go to the My Account menu click View Form 26AS Tax Credit link. Therefore it is important that the tax payer should compare the. It is also known as Tax Credit Statement or Annual Tax Statement. Date of booking means the date on which TDS return is processed and amount booked in 26AS. The Form 26AS contains details of tax deducted on behalf of the taxpayer you by deductors employer bank etc.