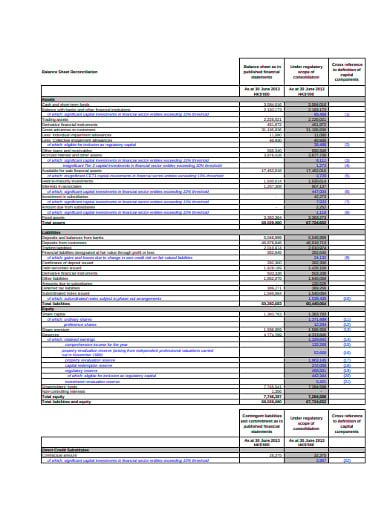

Proper reconciliation done periodically makes sure that the Balance Sheet the most important report for your company and your income expense statement is correct in all respects. Account reconciliation also confirms that accounts in the general ledger are consistent accurate and complete. Companies generally perform balance sheet reconciliations every month after the prior months books are closed. Balance sheet reconciliations are simply a comparison of the amounts that appear on your balance sheet general ledger accounts to the details that make up those balances while also ensuring that any differences between the two are adequately and reasonably explained. PLEASE LIKE SHARE AND SUBSCRIBE. A bank reconciliation statement is a document that compares the cash balance on a companys balance sheet to the corresponding amount on its bank statement. Ensuring transparency in all transactions This point proves why through bank sheet reconciliation you hold a tight leash over your company. Reconciling your companys balance sheet is one of the key elements to closing the books at the end of an accounting period. Balance sheet reconciliations are a vitally important part of a companys financial reporting process. By Ryan LaskerOct 29 20208 mins to read.

Ensuring transparency in all transactions This point proves why through bank sheet reconciliation you hold a tight leash over your company. Proper reconciliation done periodically makes sure that the Balance Sheet the most important report for your company and your income expense statement is correct in all respects. A bank reconciliation statement is a document that compares the cash balance on a companys balance sheet to the corresponding amount on its bank statement. Companies generally perform balance sheet reconciliations every month after the prior months books are closed. Reconciling the two accounts helps identify whether accounting changes are needed. By Ryan LaskerOct 29 20208 mins to read. They are done at regular intervals and are a part of routine accounting procedures. PLEASE LIKE SHARE AND SUBSCRIBE. Reconciliation A balance sheet ledger account reconciliation is the comparison of an asset or liability balance in the general ledger to another source of financial data such as a bank statement a sub-ledger or another system. Balance sheet reconciliation can be defined as a process of verifying the accuracy of information presented in the balance sheet.

Reconciling your companys balance sheet is one of the key elements to closing the books at the end of an accounting period. Account reconciliation also confirms that accounts in the general ledger are consistent accurate and complete. Balance sheet reconciliations are a vitally important part of a companys financial reporting process. Companies generally perform balance sheet reconciliations every month after the prior months books are closed. A bank reconciliation statement is a document that compares the cash balance on a companys balance sheet to the corresponding amount on its bank statement. Balance sheet reconciliation can be defined as a process of verifying the accuracy of information presented in the balance sheet. Reconciliation A balance sheet ledger account reconciliation is the comparison of an asset or liability balance in the general ledger to another source of financial data such as a bank statement a sub-ledger or another system. Ensuring transparency in all transactions This point proves why through bank sheet reconciliation you hold a tight leash over your company. This type of account reconciliation involves reviewing all the accounts on the balance sheet to ensure that the transactions were correctly posted to the correct general ledger account. Balance sheet reconciliations are simply a comparison of the amounts that appear on your balance sheet general ledger accounts to the details that make up those balances while also ensuring that any differences between the two are adequately and reasonably explained.

Companies generally perform balance sheet reconciliations every month after the prior months books are closed. Reconciliation is an accounting process that ensures that the actual amount of money spent matches the amount shown leaving an account at the end of a fiscal period. It includes cross-checking the closing balance of all the components of the balance sheet. Proper reconciliation done periodically makes sure that the Balance Sheet the most important report for your company and your income expense statement is correct in all respects. Balance sheet reconciliations are simply a comparison of the amounts that appear on your balance sheet general ledger accounts to the details that make up those balances while also ensuring that any differences between the two are adequately and reasonably explained. Ensuring transparency in all transactions This point proves why through bank sheet reconciliation you hold a tight leash over your company. A bank reconciliation statement is a document that compares the cash balance on a companys balance sheet to the corresponding amount on its bank statement. They provide support and evidence that the numbers are accurate. Balance sheet reconciliations are simply a comparison of the amounts that appear on your balance sheet general ledger accounts to the details that make up those balances while also ensuring that any differences between the two are adequately and reasonably explained. By Ryan LaskerOct 29 20208 mins to read.

According to Investopedia the definition of account reconciliation is an accounting process that compares two sets of records to check that figures are correct and in agreement. Proper reconciliation done periodically makes sure that the Balance Sheet the most important report for your company and your income expense statement is correct in all respects. Reconciliation A balance sheet ledger account reconciliation is the comparison of an asset or liability balance in the general ledger to another source of financial data such as a bank statement a sub-ledger or another system. This type of account reconciliation involves reviewing all the accounts on the balance sheet to ensure that the transactions were correctly posted to the correct general ledger account. They are done at regular intervals and are a part of routine accounting procedures. Ensuring transparency in all transactions This point proves why through bank sheet reconciliation you hold a tight leash over your company. Balance sheet reconciliations are simply a comparison of the amounts that appear on your balance sheet general ledger accounts to the details that make up those balances while also ensuring that any differences between the two are adequately and reasonably explained. They provide support and evidence that the numbers are accurate. Reconciling the two accounts helps identify whether accounting changes are needed. Companies generally perform balance sheet reconciliations every month after the prior months books are closed.