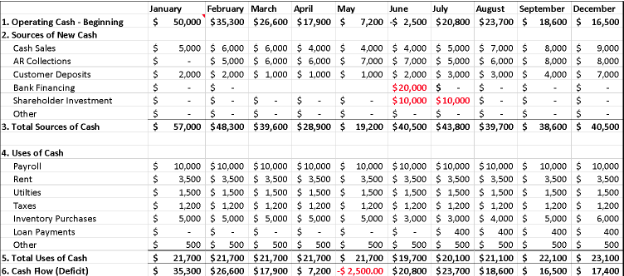

In this the future projections are made for the cash inside the company. Essentially the cash flow projection is a forecast of your organizations cash income and expenditures on a weekly or monthly basis. A cash flow projection estimates the money you expect to flow in and out of your business including all of your income and expenses. When projecting cash flow you are concerned with both the amount and timing of spending. 4- List your revenues as rows Under the Items start your first category which is Revenues. Cash flow projection is a statement showcasing the expected amount of money to be received into or paid out of the business over a period of time. Preparing cash flow projections is like preparing a budget and balancing your checkbook at the same time. Fortunately spending less than an hour each month on a cash flow projection can help you identify potential cash shortfalls in the months ahead. It ultimately provides an overview of how much cash the business is expected to have on hand at the end of each month. However you can still use the forecast to develop benchmarks for when trouble is ahead.

Cash-flow projection statements are about the state of future cash flows which means they require forecasts. Essentially the cash flow projection is a forecast of your organizations cash income and expenditures on a weekly or monthly basis. Cash flow projection is a statement showcasing the expected amount of money to be received into or paid out of the business over a period of time. The cash flow forecast is a projection which means what will actually happen in your business is still unknown. It is usually prepared on a monthly basis but that can be reduced to a shorter period of say a week and also can be extended to include 5 to 10 years. Cash flows refer to the movements of money into and out of a business typically categorized as cash flows from operations investing and financing. A cash flow forecast is an estimated projection of the amount of money you expect to flow in and out of the business over a set period of time such as the next month quarter or year. What is Cash Flow Projection. Operating cash flow includes all. Typically most businesses cash flow projections cover a 12-month period.

When projecting cash flow you are concerned with both the amount and timing of spending. The cash flow forecast is a projection which means what will actually happen in your business is still unknown. It includes all projected income and projected costs as well as estimates for payment timing. And this cash flow projection template is very useful it tell us the cash position of the firm this statement is made inside the company by the accountant or finance managers of the company to check the company cash position cash is the liquid asset. Cash Flow Projection means the Closing Budget as defined in the DIP Facility dated November 5 2001 a copy of which has been previously provided to AMCE as modified in accordance with Section 701 f of the DIP Facility or as updated in the Ordinary Course of Business. It is usually prepared on a monthly basis but that can be reduced to a shorter period of say a week and also can be extended to include 5 to 10 years. A good cash flow projection template is essential as it influences business planning budgeting and is vital during the decision-making process. Cash Flow Projections means a detailed schedule of all cash Distributions projected to be made to the Borrower from the Borrower Subsidiaries as detailed on the model delivered to the Administrative Agent prior to the Closing Date attached hereto as Exhibit H and subject to change as shall be detailed in the respective Officers Certificate to be provided to the Administrative Agent as set forth herein as may. Cash flow projection is a statement showcasing the expected amount of money to be received into or paid out of the business over a period of time. A 12 months cash flow projection template mostly serve budgeting purposes while a minimum 3 year cash flow projection template is needed to come up with a longer-term financial plan.

A cash flow forecast is an estimated projection of the amount of money you expect to flow in and out of the business over a set period of time such as the next month quarter or year. A cash flow forecast breaks down the various components involved in deriving what will make up or contribute to a future cash position. The cash flow forecast is a projection which means what will actually happen in your business is still unknown. This translates into multiple forecastssales forecasts forecasts of expenses forecasts for necessary investments and forecasts for a businesss financing requirements Cadden and. Cash-flow projection statements are about the state of future cash flows which means they require forecasts. What is Cash Flow Projection. Fortunately spending less than an hour each month on a cash flow projection can help you identify potential cash shortfalls in the months ahead. Cash flow projection is a statement showcasing the expected amount of money to be received into or paid out of the business over a period of time. A cash flow projection estimates the money you expect to flow in and out of your business including all of your income and expenses. Cash flows refer to the movements of money into and out of a business typically categorized as cash flows from operations investing and financing.

A cash flow forecast is an estimated projection of the amount of money you expect to flow in and out of the business over a set period of time such as the next month quarter or year. Preparing cash flow projections is like preparing a budget and balancing your checkbook at the same time. A 12 months cash flow projection template mostly serve budgeting purposes while a minimum 3 year cash flow projection template is needed to come up with a longer-term financial plan. Typically most businesses cash flow projections cover a 12-month period. But unlike your budget it deals only with cash transactions over a specified period of time. Before you create a cash flow projection for your business its important to identify your key assumptions about how. 4- List your revenues as rows Under the Items start your first category which is Revenues. A cash flow projection estimates the money you expect to flow in and out of your business including all of your income and expenses. It is usually prepared on a monthly basis but that can be reduced to a shorter period of say a week and also can be extended to include 5 to 10 years. Obviously you must have sufficient cash for payroll.