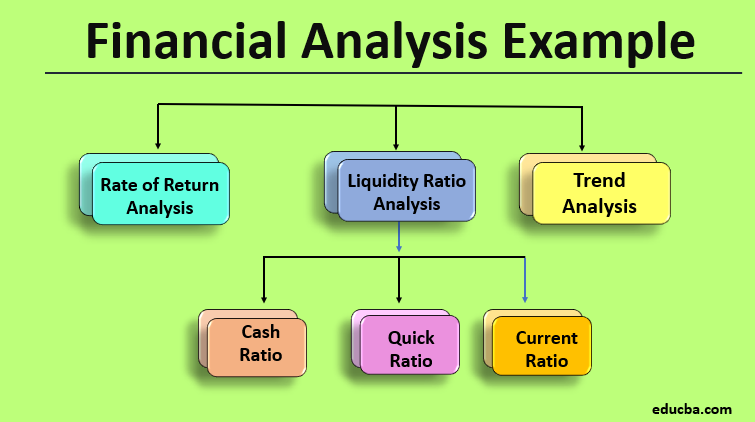

In the financial aspect those two companies will be observed from horizontal vertical trend and ratio four parts within two years. Executive Summary The report is intended to assess the financial performance of two well-known companies in the retail sector of the United Kingdom. Comparative Analysis of Financial Statements Between Two Companies With the objective to understand the business performance of the two entities we reviewed the 2007 financial statements of both company and tried to obtain some insight on the profitability and solvency of each entity. The provided reports include two-year comparison reports five-year trend analysis reports industry and group comparison reports definitions of categories and ratio formulas. Comparative Analysis of Financial Statements Between Two Companies. You will not get away with data for one year. The analysis and comparison of the financial statements of companies that use different inventory methods are best explained by an example. Accounting ratio is one number that expressed in terms of another relationship between two or various figures and company that can be compared. Investors generally use ratios to evaluate companies and make comparisons between companies within an industry. As outlined in the Financial Analysis CS Getting Started guide.

Thank you for the opportunity to review Sample Companys financial statements and make this ratio analysis as well as some recommendations about possible investment in this company. Lets do a comparison of the financial statements of two publicly traded companies. This report has analyzed and compared the financial position of two renowned hotels ie. Investors generally use ratios to evaluate companies and make comparisons between companies within an industry. As outlined in the Financial Analysis CS Getting Started guide. This is an assignment of Comparative analysis of Financial Statement of two Companies. Objectives This Study will examine the financial statement and analysis its financial prospects in terms of liquidity debt company performance efficiency and the market performance of the market. This analysis detects changes in a companys performance and highlights trends. The Operating results are deduced from observing financial trends performing benchmark analysis and calculating financial ratios. The financial battle of the tech giants.

It has been prepared by a group of fore students for the Financial Accounting. Objectives This Study will examine the financial statement and analysis its financial prospects in terms of liquidity debt company performance efficiency and the market performance of the market. Example it can be shown in a view from balance sheet profit and loss account and budgetary control system or in any accounting organization that shows relationship between accounting data. This report has analyzed and compared the financial position of two renowned hotels ie. A Case Report on the Financial Statements of Reed Elsevier and Thomson Corporation Executive Summary With the objective to understand the business performance of the two entities we reviewed the 2007 financial statements of both company and tried to obtain. In the financial aspect those two companies will be observed from horizontal vertical trend and ratio four parts within two years. The analysis will be divided into both financial and non-financial parts. The following comparative information is provided for company A and B wherein company A uses the LIFO method while company B uses the FIFO method for valuing inventories. Using financial statements from 1999 2000 and 2001 along with standard financial ratio analysis I have been able to develop what I believe is a clear picture. Hyatt hotels Corporation and Starwood hotels Corporation.

The financial battle of the tech giants. To the Shareholders and Board of Directors of The Gap Inc. A detailed comparison of the two companies using all of the relevant ratios and the calculations involved. Ratio analysis simplifies the process of comparing the financial statements of. Both companies are in the retail apparel industry. The analysis and comparison of the financial statements of companies that use different inventory methods are best explained by an example. Horizontal analysis involves taking several years of financial data and comparing them to each other to determine a growth rate. Total debt to equity ratio DAFODILCOM have comparatively higher debt portion relative to the equity than other two companies. The Operating results are deduced from observing financial trends performing benchmark analysis and calculating financial ratios. This is an assignment of Comparative analysis of Financial Statement of two Companies.

Comparative Analysis of Financial Statements Between Two Companies. When building financial models. Ratio analysis simplifies the process of comparing the financial statements of. The provided reports include two-year comparison reports five-year trend analysis reports industry and group comparison reports definitions of categories and ratio formulas. Using financial statements from 1999 2000 and 2001 along with standard financial ratio analysis I have been able to develop what I believe is a clear picture. Investors generally use ratios to evaluate companies and make comparisons between companies within an industry. A Case Report on the Financial Statements of Reed Elsevier and Thomson Corporation Executive Summary With the objective to understand the business performance of the two entities we reviewed the 2007 financial statements of both company and tried to obtain. This report has analyzed and compared the financial position of two renowned hotels ie. Example it can be shown in a view from balance sheet profit and loss account and budgetary control system or in any accounting organization that shows relationship between accounting data. This will help an analyst determine if a company is growing or declining and identify important trends.