When is a PAN Correction required on TRACES. What is quarterly e-TDS return statement. The Conso Files and Justification Reports downloaded from TRACES help you to identify errors in submission of revised Quarterly TDS Statements. There are various ways to check your TDS status but the most common amongst all is via PAN Card. Link Aadhaar to Permanent Account Number PAN e-TDSTCS RPU version 36 for Statements from FY 2007-08 onwards is released 01042021. HOW TO MATCH PAN CARD DETAILS WITH AADHAAR CARD DETAILS. See more How to apply for PAN. The demand in the hands of the deductors is being rectified in cases where thedifference between the Invalid PAN and the Valid PAN is not more than 2 characters. INCOME TAX COST OF INFLATION INDEX FROM 2001-2002 TO 2018-2019. Current Updates New Articles.

Deductor should do PAN Correction when the following PAN errors occur. This is being done in order to take care of the genuine typographical errors in data entry. File Income Tax Return. To check the status of TDS using the PAN card one needs to follow the steps mentioned below. Only Valid PANs reported in the TDSTCS statement corresponding to the CINBIN detailsin Part1 must be entered in Part2 of the KYC. You can now check the status of TDS returns by accessing a bank statement or. There are various ways to check your TDS status but the most common amongst all is via PAN Card. See more How to apply for PAN. HOW TO MATCH PAN CARD DETAILS WITH AADHAAR CARD DETAILS. The Conso Files and Justification Reports downloaded from TRACES help you to identify errors in submission of revised Quarterly TDS Statements.

TDSTCS File validation utility FVU versions 2167 for FY 2007-08 to FY 2009-10 and 71 for FY 2010-11 onwards are released 01042021. Only a typographical error is expected at the time of filing the TDS statement. What is quarterly e-TDS return statement. Select the financial year as well as the quarter and the type of return. PAN not available with CPCTDS 3. TAX INFORMATION AND SERVICES. How To Check TDS Status By Pan Card. NSDL e-Gov RPU_e-Tutorial Version 17 Form 24G. You can now check the status of TDS returns by accessing a bank statement or. Both these portals require your PAN Number.

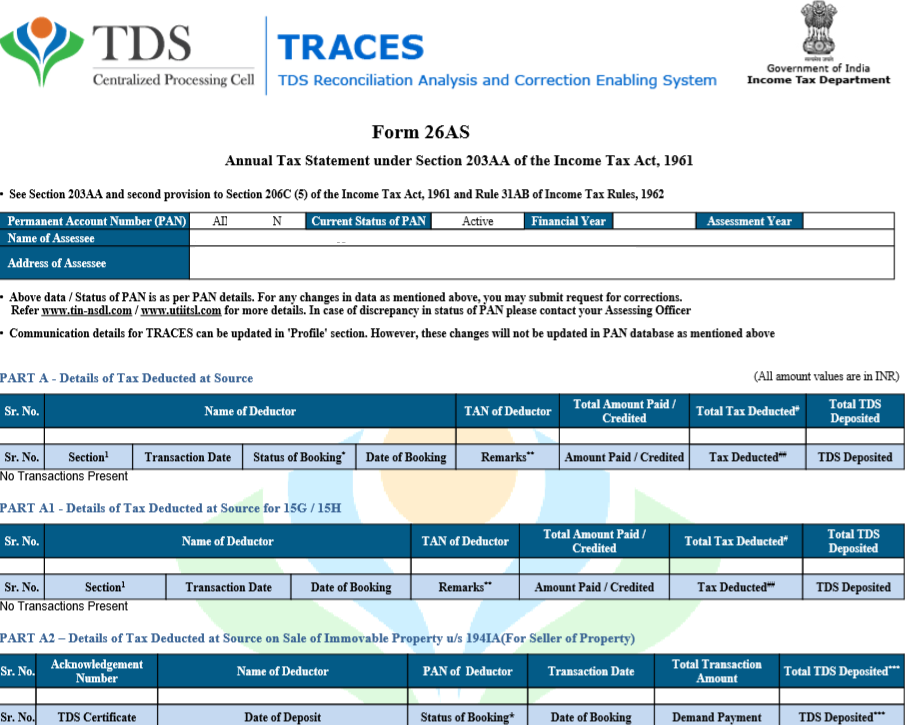

Link Aadhaar to Permanent Account Number PAN e-TDSTCS RPU version 36 for Statements from FY 2007-08 onwards is released 01042021. PAN Verification and Consolidated TAN PAN File facility on TRACES can be used for verifying the deductees. The form used for quarterly e -TDS returns are Form 24Q 26Q and 27Q. However TDS Credit can also be checked via Form 26AS which is a consolidated tax statement and contains details of tax deposited or credited. TDSTCS File validation utility FVU versions 2167 for FY 2007-08 to FY 2009-10 and 71 for FY 2010-11 onwards are released 01042021. Only a typographical error is expected at the time of filing the TDS statement. NSDL e-Gov RPU_e-Tutorial Version 17 Form 24G. Guide available on the screen can be referred for valid combinations. There are two ways to check your TDS status. Permanent Account Number PAN is a ten-digit alphanumeric number issued in the form of a laminated card by the Income Tax Department to any person who applies for it or to whom the department allots the number.

Go to httpswwwtdscpcgovinapptapntdstcscreditxhtml to view the Status of e-filing of TDS Statement by your deductor. PAN not available with CPCTDS 3. NSDL e-Gov RPU_e-Tutorial Version 17 Form 24G. Cost with reference to certain modes of Acquisition. How To Check TDS Status By Pan Card. HOW TO MATCH PAN CARD DETAILS WITH AADHAAR CARD DETAILS. Current Updates New Articles. When is a PAN Correction required on TRACES. Guide available on the screen can be referred for valid combinations. Which ever is higher This clause is applicable to all type of deductee The Maximum TDS rate is applicable in following case.