ASC 946-205-45-1 Statement of changes in partners capital and 5 Year ended December 31 20XX ASC 946-505-50-2 Limited ASC 946-505-50-3 General partner partners Total Partners capital beginning of year 75884000 682957000 758841000 Capital contributions 250000 24750000 25000000. The differences between the two are as follows. The statement of partners capital shows the changes in each partners capital account for the year or period being reported on. A Statement of Owners Equity shows the changes in the capital account of a sole proprietorship. See accompanying notes to financial statements. A financial report showing all changes in the total of partners capital account during a particular accounting year is known as the statement of partnerships equity. Income Statement For The Year Ended 30 June 2009 RM Revenue 595000 Cost of sales -195490 Gross profit 399510 Other operating income Interest income 2560 Distribution administrative and other expenses Carriage outward - 25897 Advertising and promotions. It is not considered an essential part of the monthly financial statements and so is the most likely of all the financial statements not to be issued. They may also be due to changes in income such as net income for the given accounting period or revaluation of fixed assets to name a few. New partner can pay a bonus to existing partners by paying more than interest percentage received.

A statement of changes in equity can be explained as a statement that can changes in equity for corporation features be created for partnerships sole proprietorships or corporations. Title instead of owners partners is used to denote that this is a partnership b. Assume Sun and Rain partnership equity is 190000 total. They may also be due to changes in income such as net income for the given accounting period or revaluation of fixed assets to name a few. The statement of partners capital shows the changes in each partners capital account for the year or period being reported on. The statement of partners capital is a financial report that shows the changes in total partners capital accounts during an accounting period. It is not considered an essential part of the monthly financial statements and so is the most likely of all the financial statements not to be issued. A Statement of Change in Equity is a financial statement that shows the changes in the share owners equity over a specific accounting period. ASC 946-505-50-3 Partners capital end of year 70302100084219000 787240000 1 ASC paragraph 946-205-45-5 permits nonregistered investment partnerships to combine the statement of changes in net assets with the statement of changes in partners capital if the information in ASC paragraph 946-205-45-3 is presented. The income statements of partnerships should be presented in a manner which clearly shows the aggregate amount of net income loss allocated to the general partners and the aggregate amount allocated to the limited partners.

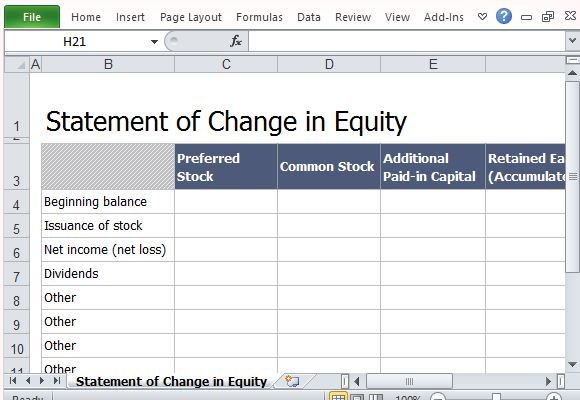

A statement of change in equityis therefore created to report with variations in equity for business sorts whether it is aimed at partnerships corporations or sole proprietorships. It has the same format as the statement of owners equity except that it includes a column for each partner and a total column for the company rather than just one column. New partner can pay a bonus to existing partners by paying more than interest percentage received. The statement of changes in equity is a reconciliation of the beginning and ending balances in a companys equity during a reporting period. Statement of Changes in Equity often referred to as Statement of Retained Earnings in US. The Statement of Partners Capital. A financial report showing all changes in the total of partners capital account during a particular accounting year is known as the statement of partnerships equity. These changes arise from contributions withdrawals and net income or net loss. GAAP details the change in owners equity over an accounting period by presenting the movement in reserves comprising the shareholders equity. These changes may be the result of shareholders transactions such as new shares and dividend payments.

Therefore the statement of partnership equity is a financial statement that reports all increases and decreases in the partners capital accounts over the period of time. The statement of partners capital is a financial report that shows the changes in total partners capital accounts during an accounting period. The ultimate aim of the statement remains to provide a brief movement for all the equity accounts within a specific time period. ASC 946-505-50-3 Partners capital end of year 70302100084219000 787240000 1 ASC paragraph 946-205-45-5 permits nonregistered investment partnerships to combine the statement of changes in net assets with the statement of changes in partners capital if the information in ASC paragraph 946-205-45-3 is presented. Statement of Changes in Equity often referred to as Statement of Retained Earnings in US. The statement of changes in equity is a columnar statement which as its name implies reconciles the movements or changes during the period for all of the components under the equity section of the statement of financial position. This occurs when the partnership has a current market value greater than the current partners equity. There are two or more owners in a partnership thus the changes in the capital account of each partner is presented. A statement of change in equityis therefore created to report with variations in equity for business sorts whether it is aimed at partnerships corporations or sole proprietorships. Such components include share.

A Statement of Change in Equity is a financial statement that shows the changes in the share owners equity over a specific accounting period. The statement of changes in equity is a columnar statement which as its name implies reconciles the movements or changes during the period for all of the components under the equity section of the statement of financial position. Continue reading Sample Income Statement Balance Sheet and Statement Of Changes In Equity Of Partnership A B Co. The statement of partners capital shows the changes in each partners capital account for the year or period being reported on. It has the same format as the statement of owners equity except that it includes a column for each partner and a total column for the company rather than just one column. In other words its a financial statement that reports the increases and decreases in the partners accounts over the course of a period. Well go through a sample and discuss important details about this financial statement. The statement of changes in equity is a reconciliation of the beginning and ending balances in a companys equity during a reporting period. A statement of changes in partnership equity for each ownership class should be furnished for each period for which an income statement is included. These changes may be the result of shareholders transactions such as new shares and dividend payments.