Ad Get Your Trial Balance Template Download Print in Minutes. Lists all the companys general ledger accounts and their balances. It contains a list of all the general ledger accounts. The unadjusted trial balance the adjusted trial balance and the post- closing trial balance. A trial balance is a conglomerate of or list of debit and credit balances extracted from various accounts in the ledger including cash and bank balances from cash book. The rule to prepare trial balance is that the total of the debit balances and credit balances extracted from the ledger must tally. Trading account Profit and Loss account and Balance. The balances of the ledgers are added to the debit and credit columns. An accounting period may be. A trial balance Is used to verify that the total of debit balances is equal to the total of credit balances.

The purpose of a trial balance is to ensure that all entries made into an organizations general ledger are properly balanced. The trial balance is useful for checking the arithmetic accuracy and correctness of the bookkeeping entries. The total dollar amount of the debits and credits in each accounting entry are supposed to match. It is usually prepared at the end of an accounting period to assist in the drafting of financial statements. It contains a list of all the general ledger accounts. Trial balance is a statement of all debits and credits in a double-entry account book. A trial balance is a conglomerate of or list of debit and credit balances extracted from various accounts in the ledger including cash and bank balances from cash book. Trading account Profit and Loss account and Balance. The trial balance report is an accounting report that lists the closing balances of the general ledger accounts. The rule to prepare trial balance is that the total of the debit balances and credit balances extracted from the ledger must tally.

Trial balance is a statement of all debits and credits in a double-entry account book. All three have exactly the same format. The trial balance report is an accounting report that lists the closing balances of the general ledger accounts. Often the accounts with zero balances will not be listed The debit balance amounts are listed in a column with the heading. Lists all the companys accounts all transactions affecting accounts and ending account balances. Trial Balance is a list of closing balances of ledger accounts on a certain date and is the first step towards the preparation of financial statements. Is prepared before making adjustments. There are three types of trial balances. The term trial balance refers to as the total of all the general ledger balances. Trial Balance Accounting A trial balance sometimes abbreviated to TB is a list of all the account balances in the accounting records on a particular date.

Any deviation from expected values helps to detect errors in. A trial balance Is used to verify that the total of debit balances is equal to the total of credit balances. A trial balance lists the ending balance in each general ledger account. Verifies there are no errors in the entire accounting system. A trial balance is a list of the balances of every account from the general ledger including cash book setting out debit balances and credit balances in separate columns. The term trial balance refers to as the total of all the general ledger balances. Lists all the companys general ledger accounts and their balances. Trial Balance Accounting A trial balance sometimes abbreviated to TB is a list of all the account balances in the accounting records on a particular date. There are three types of trial balances. The total dollar amount of the debits and credits in each accounting entry are supposed to match.

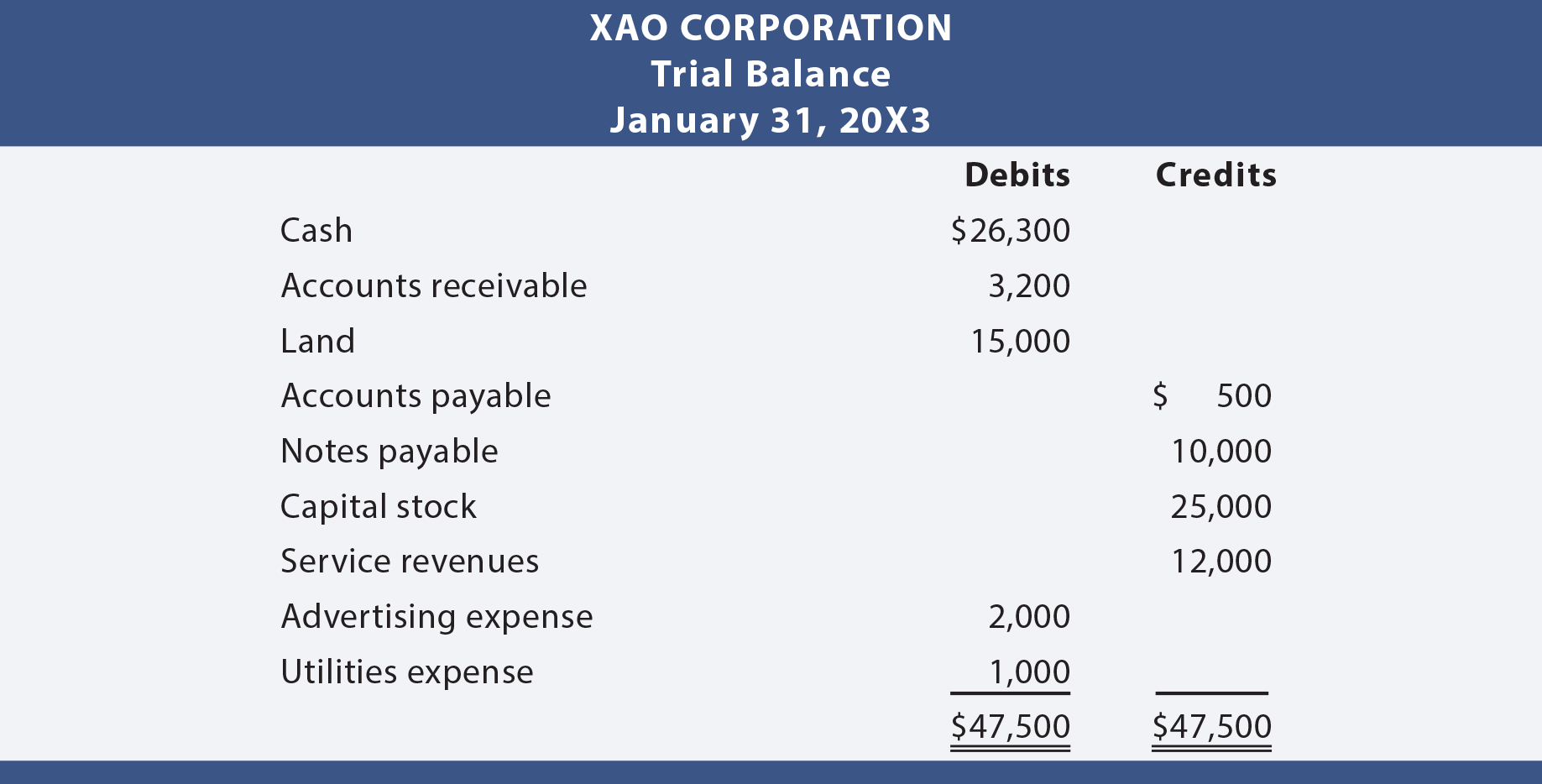

An example is shown on the next page. It helps in verifying the arithmetic accuracy of the double entry system used for the accounts. A trial balance is a conglomerate of or list of debit and credit balances extracted from various accounts in the ledger including cash and bank balances from cash book. Following is the trial balance prepared for Xao Corporation. A trial balance Is used to verify that the total of debit balances is equal to the total of credit balances. The balances are usually listed to achieve equal values in the credit and debit account totals. An accounting period may be. The term trial balance refers to as the total of all the general ledger balances. Any deviation from expected values helps to detect errors in. There are three types of trial balances.