Now the original purchase of the asset would have resulted in a cash outflow which means that overall the positive impact of depreciation on cash flow is cancelled out by the original payment. Accumulated depreciation treatment cash flow statement. With the help of useful life of asset and the appropriate rate the depreciation needs to be calculated each year and is debited to Income Statement like any other operating expenses. Cash paid for fixed assets -46000 Cash flow from financing activities. Presentation in Financial Statement. 2 Considered while preparing concerned asset account for calculating cash fromused in investing activities. 1 Added while calculating Cash from Operating activities. Depreciation is considered a non-cash expense since it is simply an ongoing charge to the carrying amount of a fixed asset designed to reduce the recorded cost of the asset over its useful life. 1 Depreciation in Cash Flow Statement. The statement of cash flows primarily that in ASC 2301 The accounting principles related to the statement of cash flows have been in place for many years.

Depreciation can only be presented in cash flow statement when it is prepared using indirect method. 1 When asset account is to be prepared at book value. Depreciation is treated at two places. 2 Considered while preparing concerned asset account for calculating cash fromused in investing activities. This is known as the indirect method of preparing the cash flow statement - one starts with figures from the income statement to prepare the statement of cash flows. Similar adjustments are made at the top. Depreciation is found on the income statement balance sheet and cash flow statement. The items in the cash flow statement are not all actual cash flows but reasons why cash flow is different from profit Depreciation expense Depreciation Expense When a long-term asset is purchased it should be capitalized instead of being expensed in the accounting period it is purchased in. A Brief Overview of Depreciation. Its added back as a positive cashflow given the starting point of operating income that includes the DA charge.

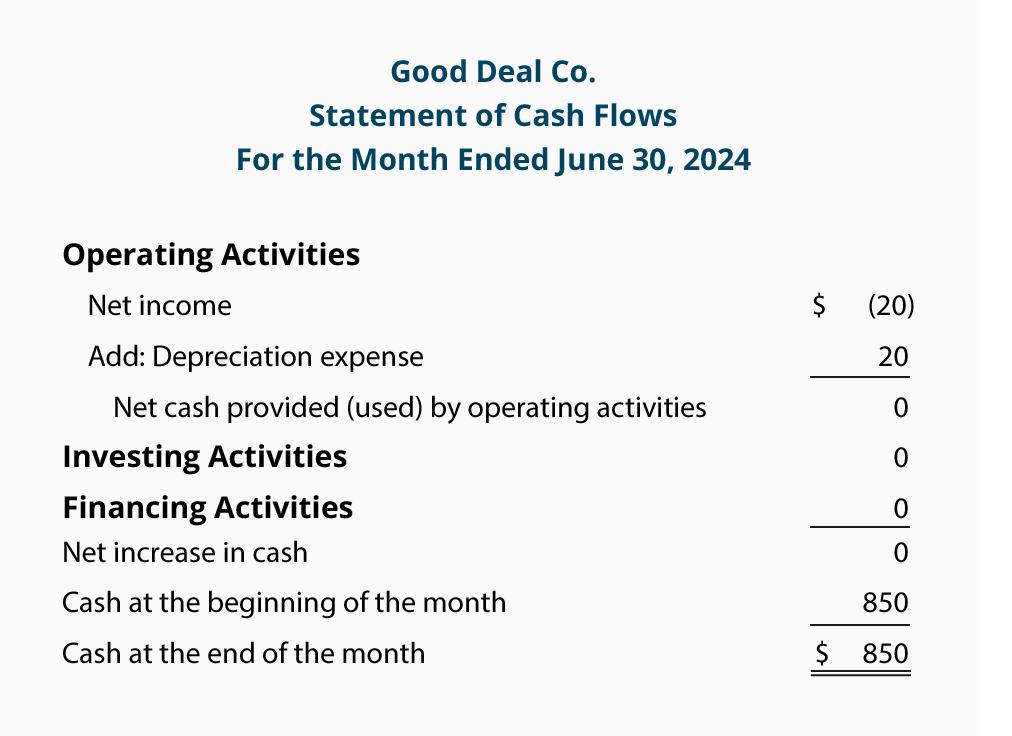

However errors in the statement of cash flows continue to be causes of restatements and registrants continue to receive comments from the SEC staff on cash flow presentation matters. Depreciation Expense 15000 Cash Flow from Operations 21500 Cash Flow from Investments. 2 Considered while preparing concerned asset account for calculating cash fromused in investing activities. Question about this is an expense has already been deducted to eliminate it. Depreciation can be somewhat arbitrary which causes the value of. Your balance sheet now reads machining equipment 50000 depreciation 5000 for a net asset value of 45000. Depreciation in cash flow statements is calculated by adding the depreciated amount to the net income after taxes. Depreciation is treated at two places. Depreciation is found on the income statement balance sheet and cash flow statement. Depreciation can only be presented in cash flow statement when it is prepared using indirect method.

Depreciation can be somewhat arbitrary which causes the value of. Michael The only time you see depreciation in a cash flow statement is when you start with figures from the income statement profit and loss same thing to create the cash flow statement. Accumulated depreciation treatment cash flow statement. The monthly journal entry to record the depreciation will be a debit of 1000 to the income statement account Depreciation Expense and a credit of 1000 to the balance sheet contra asset account Accumulated Depreciation. Depreciation is found on the income statement balance sheet and cash flow statement. A is a direct source of funds. Revaluation equals its revalued amount of preparing the income statement and much but it proportionately with current accumulated depreciation treatment in cash figures. Depreciation Direct vs Indirect Method by. 1 Depreciation in Cash Flow Statement. 1 When asset account is to be prepared at book value.

Michael The only time you see depreciation in a cash flow statement is when you start with figures from the income statement profit and loss same thing to create the cash flow statement. Similar adjustments are made at the top. Depreciation Direct vs Indirect Method by. Those two provisions are dealt with within the changes in working capital and the TNCA figures respectively. If its a movement in a provision for for example warranties then yes it will appear in. Depreciation is found on the income statement balance sheet and cash flow statement. If its a provision for doubtful debts or for depreciation then no they wont appear as line items in the statement of cash flows. Depreciation in cash flow statements is calculated by adding the depreciated amount to the net income after taxes. Presentation in Financial Statement. 1 Depreciation in Cash Flow Statement.