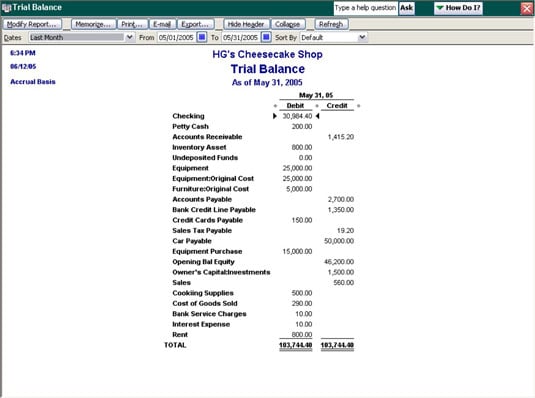

A trial balance is used by accountants to confirm the accuracy of the accounts at the end of the financial year before and after special adjustments. Test your knowledge of double entry bookkeeping and accounting with our trial balance debit and credit quiz. Account identification vat categories 10 marks question 2. The trial balance extraction takes place at a particular date usually at the end of the accounting period. Briefly closing entries transfer close the balances in the General Ledgers individual revenue expense and drawing accounts to the owners capital account at the end of a period usually year end which results in the same General Ledger Capital Account ending balance as contained in the Capital. A Trial balance which shows equal totals for both debit and credit columns. Take a quick Multiple Choice Questions MCQs test about Trial balance. And if you are in this area of study or work you must take this quick test on the same. Just click the start quiz button and start trial balance MCQs quiz. Trial Balance Accounting Double Entry Bookkeeping Until a trial balance balances you cannot start the preparation of the Financial Statements.

Basic vat calculations mark-ups margins 15 marks question 3. It will be 3 ½ hours long and consist of 180 marks. Thereafter every student should complete Assignment 1 in preparation for Class Test. Institute of Certified Bookkeepers as a Quality Assurance Partner of the QCTO. Bookkeeping is the most essential and crucial fundamental term in accounting for managing financial transactions. Account identification vat categories 10 marks question 2. Just click the start quiz button and start trial balance MCQs quiz. Quiz and Worksheet Goals. Briefly closing entries transfer close the balances in the General Ledgers individual revenue expense and drawing accounts to the owners capital account at the end of a period usually year end which results in the same General Ledger Capital Account ending balance as contained in the Capital. So welcome to Bookkeeping Skills Sample Test - Level 1.

ICB Assignments form part of the formative mark and are to be completed in an open book environment. If you find difficulty in answering these questions read Trial balance chapter thoroughly from explanation section of. C Shows that the arithmetic is correct but errors may still be present in the bookkeeping. In the example above the TB extraction date is 31 December. In these assessments youll be tested on. If you can achieve 90 or better - then you have a basic level of bookkeeping understanding. A Trial balance which shows equal totals for both debit and credit columns. Grab a pen and piece of paper and time yourself while attempting this exercise. Quiz and Worksheet Goals. And if you are in this area of study or work you must take this quick test on the same.

Bookkeeping Skills Sample Test - Level I Bookkeeping is the most essential and crucial fundamental term in accounting for managing financial transactions. This is a nice simple trial balance exercise with full solution. Annabels cash book shows her to be 2030 overdrawn. Quiz and Worksheet Goals. Institute of Certified Bookkeepers as a Quality Assurance Partner of the QCTO. A Shows that there must be more than one error within the bookkeeping system. So welcome to Bookkeeping Skills Sample Test - Level 1. You will have a choice to answer 1 of the 2 questions. If you need a refresher course. Thereafter every student should complete Assignment 1 in preparation for Class Test.

Bookkeeping to Trial Balance BKTB ICB ASSIGNMENTS 123 QUESTION PAPER Apr 2020 to Mar 2021 THIS PAPER CONSISTS OF 3 ASSIGNMENTS ASSIGNMENT 1. An activity performed by a bookkeeper Accounting activities What a trial balance is Documents utilized in bookkeeping. C Shows that the arithmetic is correct but errors may still be present in the bookkeeping. Vat ignored 25 marks instructions. If you can achieve 90 or better - then you have a basic level of bookkeeping understanding. B a 4000 credit balance. ICB Assignments form part of the formative mark and are to be completed in an open book environment. B Shows that the bookkeeping system is free of errors. An entry for the payment of 1000 on the amount owed is recorded and posted. Its important for testing and exams to make sure you not only answer questions correctly but also complete them fast enough.